The Definitive Guide for Atlanta Hard Money Lenders

Table of ContentsThe Best Strategy To Use For Atlanta Hard Money LendersAtlanta Hard Money Lenders Can Be Fun For AnyoneThe 8-Second Trick For Atlanta Hard Money LendersThe Ultimate Guide To Atlanta Hard Money LendersRumored Buzz on Atlanta Hard Money LendersWhat Does Atlanta Hard Money Lenders Mean?

Capitalist A recognizes the benefits of property investing in St. Louis and also expanding a rental profile to develop riches and financial liberty. He has actually never ever come across hard money and as a beginning financier does not understand just how to money his property bargains. He secures a HELOC on his personal house, including a burden to his debt-to-income ratio on his credit rating.

Little Known Questions About Atlanta Hard Money Lenders.

Investor B finds an article called "What is Hard Money Lending in St Louis" by Arielle Morris as well as discovers concerning all the advantages to hard money. As a benefit of working with them, she gets the first choice of their wholesale offers.

Financier B has none of her own funding in the realty deal and she shuts at a regional title firm in 1 week! Investor B has the entire house remodelled in a month's time. Her difficult money lender places her in contact with a fantastic industrial financial institution lending institution who does a re-finance on the home.

When the bank re-finance goes through, Investor B pays off the difficult cash loan provider and also has no early repayment penalties. Financier B has no money in the genuine estate deal.

The 6-Second Trick For Atlanta Hard Money Lenders

These points can happen when the finance is come from or on the backend of the job or often both. Some difficult money lending institutions begin with a greater rate of interest rate and also check this site out if you do a link specific amount of take care of them over time then they'll decrease your passion price once a consumer reaches this threshold.

See to it the lending institution doesn't have any type of surprise costs and that they have a respectable online reputation within the marketplace you are spending in. Faster, Funds Offering in St Louis offers an affordable price with no hidden or concealed fees. They are extremely advised by rehabbers as well as fins in the St Louis area as well as take satisfaction in their premium quality of customer service.

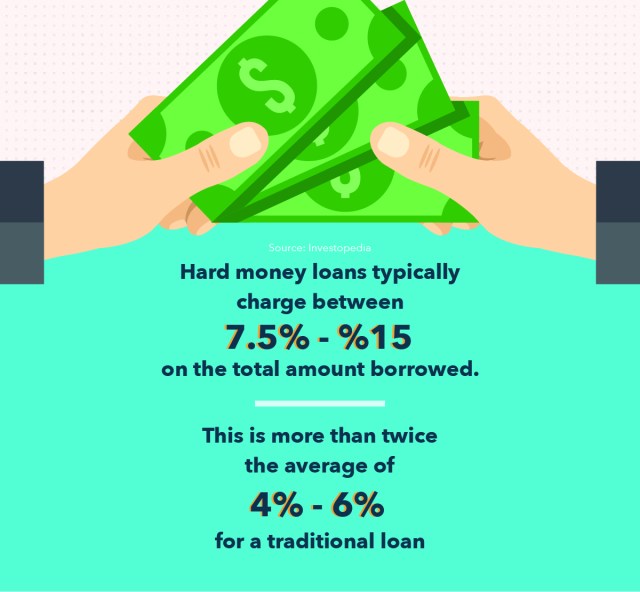

The fundings are riskier for the lending institution as well as are for short-term lending requires just. The rate of interest prices are greater than traditional bank financings. Having a greater passion price can often be depicted as an adverse if a prospective debtor has access to more economical types of resources. Many individuals beginning a service are not individually affluent and also access to a tough money lender in St.

In this way, method hard money tough in Loan provider Louis is an industry equalizer sector opens as well as opens up of opportunities estate actual to financial investment. Hard cash additionally permits individuals to scale their organization via financing multiple realty financial investment residential properties at as soon as and also develops the capability to grow a business much faster.

The 9-Minute Rule for Atlanta Hard Money Lenders

There are some conditions where hard money would certainly not be the very best option for an individual circumstance. I always recommend researching all your local hard money alternatives and also different funding alternatives and also establishing the alternative ideal suited for you and your business needs (atlanta hard money lenders). Hard cash lending institutions utilize the home as collateral for their fundings.

Because of regulations like Dodd-Frank, it is not an appropriate item for visit this site a main residence. This means that if you are staying in the house a difficult money lender in St. Louis is unable to offer on the property home. Commonly, hard money is taken into consideration a business tool since it is utilized specifically for business-related purposes just.

Louis will certainly likewise offer on office complex, storage facilities, industrial, self-storage, retail, or home structures. These bigger projects are not every hard money lender's specialized. It is very important to ask if they have any type of restrictions on what they agree to offer on and also what kinds of residential properties they specialize in.

The Of Atlanta Hard Money Lenders

A hard cash lending institution in St. Louis will require that they remain in first lien position to be able to do a financing for you or your service. See to it to clarify your specific circumstance and see what alternatives the lender has for you. Discovering a tough money lender with a favorable online reputation as well as record is important.